Lawrence Pearce, specialist Construction Law solicitor at Holmes & Hills, discusses the issue of securing interim payments, in full, during the course of a construction project.

Under Section 110(1) of the Housing Grants, Construction and Regeneration Act 1996 (the “Act”) every construction contract shall “(a) provide an adequate payment mechanism for determining what payments become due under the Contract, and when, and (b) provide for a final date for payment in relation to any sum which becomes due”.

If for whatever reason the construction contract fails to provide an ‘adequate payment mechanism’ then the Scheme for Construction Contacts (England and Wales) Regulations 1998 (the “Scheme”), shall apply as an implied term.

Despite payment being at the forefront of every main contractor’s mind, it is surprising how many contractors are unaware of the consequences of failing to serve the required notices under the Contract/Scheme and the risk of a “Smash and Grab” Adjudication. Equally, lots of sub-contractors do not know the options they have available to them if a contractor fails to pay on the Final Date for Payment and/or fails to issue a valid notice in respect of an interim payment.

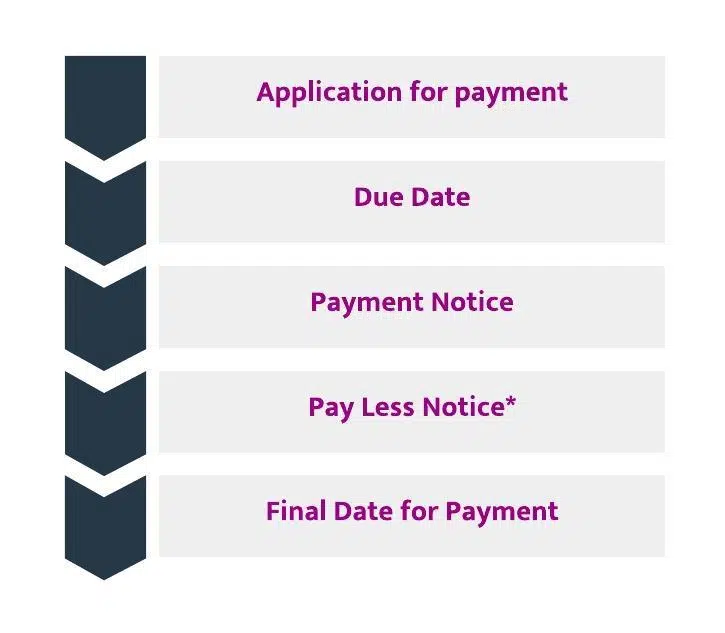

Broadly speaking, every contract should allow for the following:

* Note - The Act provides that the contract must include a provision for either a payment application (upstream) or a payment notice (downstream), however, it does not specify that a contract requires both. Although, most contracts provide for both.

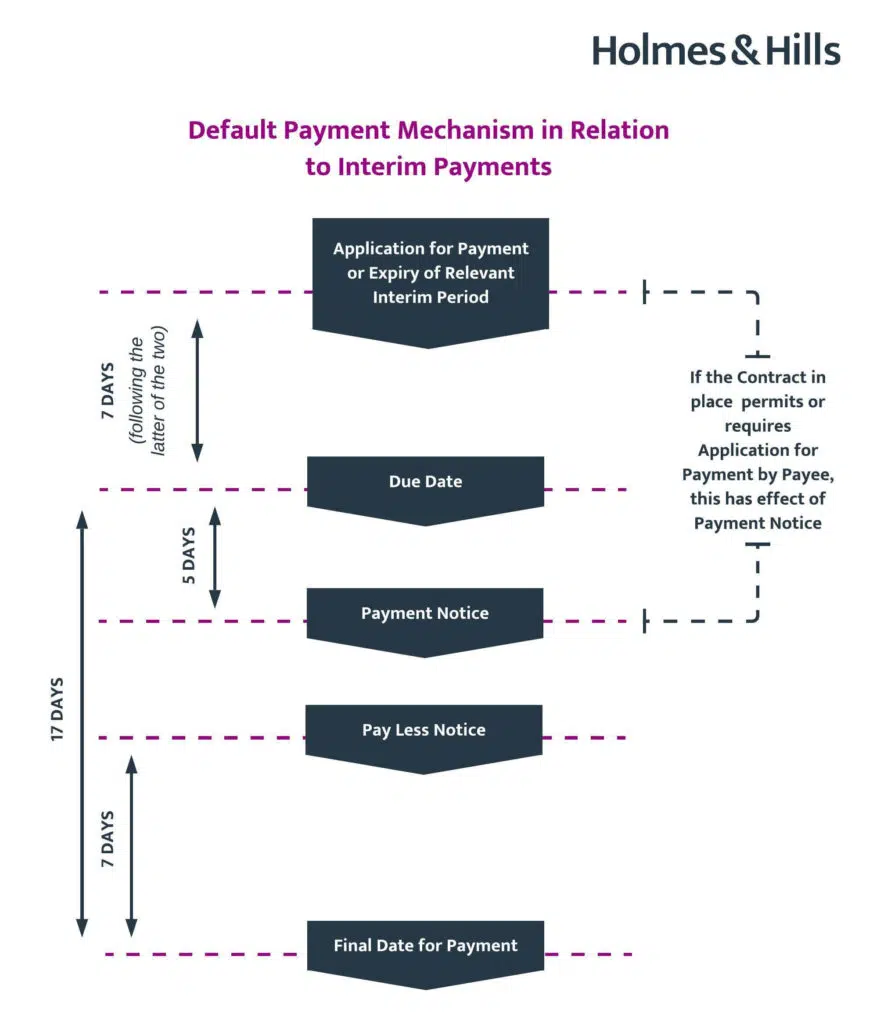

If for whatever reason the contract fails to provide an ‘adequate payment mechanism’ then the Scheme applies, including the following payment mechanism:

These provisions not only apply to your typical main contractor/sub-contractor relationship but many construction related services under professional appointments such as Architects, Surveyors and Engineers.

In accordance with Section 110A the Act, the payer (main contractor) or specified person is required to give a Payment Notice specifying the sum the payer considers to be due and the basis for calculating that sum, no later than five days after the Due Date. This applies even if the sum to be paid is zero. So, what if the payer fails to issue a valid Payment Notice?

Taking (1) above, which is the most common scenario, if the paying main contractor fails to give a Payment Notice, then the sum set out in the sub-contractor's Application for Payment must be paid by the Final Date for Payment, subject to any Pay Less Notice that is given.

Section 111(3) of the Act allows the payer to pay less than the notified sum, provided that the payer gives a notice setting out the sum they consider to be due on the date the Pay Less Notice is served and the basis on which it was calculated. The sum may be zero.

The Pay Less Notice must be served no later than the prescribed period before the Final Date for Payment. The parties are free to agree the prescribed period, failing which, the Scheme will be implied, and the Pay Less Notice must be served 7 days before the Final Date for Payment.

If the sub-contractor disagrees with the value of works and sum stipulated in the Pay Less Notice by the payer, there are a number of strategic options available, but it is recommended that specialist advice is sought from a construction solicitor as each option carries merit and risk.

If the payer (main contractor) fails to issue a valid Payment Notice or Pay Less Notice by the relevant date, then the full sum is due and payable on the Final Date for Payment without deduction. This is not a new development and this position has been well rehearsed in the Courts since the case of ISG v Seevic in 2014.

The Default Payment Mechanism and the validity of the relevant notices have been debated by the parties to construction contracts for nearly a decade. Whether or not a notice is valid and whether the full sum is due and payable at the Final Date for Payment will depend on numerous factors.

It is recommended that main contractors and sub-contractors seek specialist advice in advance of entering into a contract on a new project, to allow for advice on and negotiation of the terms of the contract and, in particular, terms relating to interim and final account payment. Very minor alterations to clauses can materially improve the position of payer or payee with implications for cash flow and risk.

As well as providing pre-contract advice, the Construction Team at Holmes & Hills Solicitors provides pragmatic and commercial legal advice during the course of a project in relation to payment matters, to minimise contractual risks and identify contractual opportunities surrounding interim payments. After all, cash is still king!

Disclaimer

The content of this article is provided for general information only. It does not constitute legal or other professional advice. The information given in this article is correct at the date of publication.

A Mackman Group collaboration - market research by Mackman Research | website design by Mackman